Data as on 04th feb 2025

Bank Of India Flexi Cap Fund

-

Fund Type : An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocksEntry Load : NilDate of Allotment : June 29, 2020

-

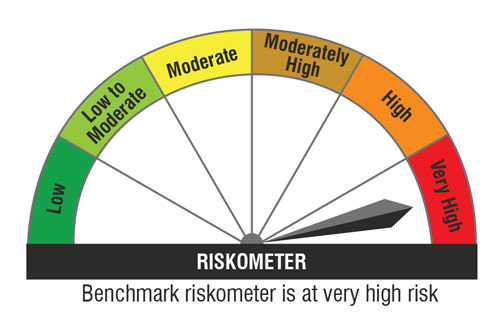

Benchmark :BSE 500 Total Return Index(TRI)Exit Load :

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity-related securities across various market capitalisation. However, there can be no assurance that the investment objectives of the Scheme will be realized.

Fund Manager

-

ALOK SINGH

CFA and PGDBA

from ICFAI Business School See detail

See detail

Fund Highlights

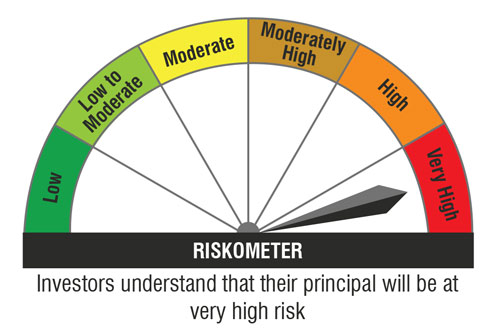

Riskometer

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Performance(Regular Plan - Growth Option & Direct Plan - Growth Option)

| Current Value of Standard Investment of Rs 10000 in the | |||||||

|---|---|---|---|---|---|---|---|

| Period | NAV Per Unit (Rs.) | Scheme | Benchmark | Additional Benchmark Returns | Schemes | Benchmarkrs | Additional Benchmark |

| 1 yrs | 32.5400 | 5.75 % | 7.74 % | 8.97 % | 10575 | 10774 | 10897 |

| 3 yrs | 19.3000 | 21.26 % | 16.41 % | 14.08 % | 17829 | 15773 | 14848 |

| 5 yrs | 13.4800 | 20.59 % | 16.42 % | 14.52 % | 25527 | 21401 | 19714 |

| 10 yrs | NA | NA | NA | NA | NA | NA | NA |

| Since inception | 10.0000 | 24.72 % | 20.80 % | 18.81 % | 34410 | 28779 | 26227 |

IDCW History(Regular Plan- Regular IDCW)

| Record Date | IDCW (`/Unit) |

| 7-December-2020 | 0.44601387 |

| 30-June-2021 | 1.00000000 |

| CLICK HERE TO VIEW THE IDCW HISTORY |