Data as on 04th feb 2025

Bank Of India short term income fund

-

Fund Type : An open ended short term debt scheme investing in instruments with Macaulay duration of the portfolio between 1 year and 3 years. A Moderate Interest Rate Risk and Moderate Credit Risk.Entry Load : NilDate of Allotment : December 18, 2008

-

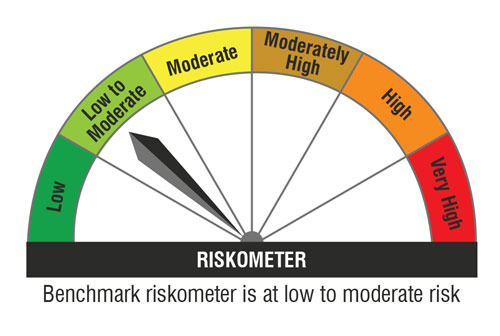

Benchmark :Tier 1: CRISIL Short Duration Debt A-II IndexExit Load :Nil

Investment Objective

The Scheme seeks to generate income and capital appreciation by investing in a diversified portfolio of debt and money market securities. However, there can be no assurance that the income can be generated, regular or otherwise, or the investment objectives of the Scheme will be realized.

Fund Manager

-

Mr. Mithraem Bharucha

BMS and MBA

See detail

See detail

Fund Highlights

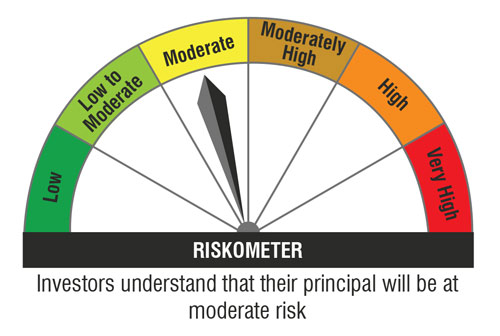

Riskometer

| Potential Risk Class Matrix | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Credit Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) | ||||||

| Interest rate Risk | |||||||||

| Relatively Low (Class I) | |||||||||

| Moderate (Class II) | B-II | ||||||||

| Relatively High (Class III) | |||||||||

Top 10 Portfolio Holdings

Credit Profile

Asset Allocation

Performance(Regular Plan - Growth Option & Direct Plan - Growth Option)

| Current Value of Standard Investment of Rs 10000 in the | |||||||

|---|---|---|---|---|---|---|---|

| Period | NAV Per Unit (Rs.) | Scheme | Benchmark | Additional Benchmark Returns | Schemes | Benchmarkrs | Additional Benchmark |

| 1 yrs | 25.8462 | 6.36 % | 7.23 % | 5.17 % | 10636 | 10723 | 10517 |

| 3 yrs | 22.3265 | 7.18 % | 7.48 % | 7.72 % | 12313 | 12415 | 12499 |

| 5 yrs | 16.9863 | 10.10 % | 6.06 % | 4.99 % | 16184 | 13427 | 12762 |

| 10 yrs | 16.0719 | 5.51 % | 7.14 % | 6.45 % | 17104 | 19947 | 16286 |

| Since inception | 10.0000 | 6.08 % | 7.48 % | 5.43 % | 27490 | 34432 | 24744 |

IDCW History(Regular Plan- Quarterly IDCW)

| Record Date | IDCW (`/Unit) |

| 25-January-2011 | 0.043921 |

| 25-January-2011 | 0.040935 |

| 25-February-2011 | 0.052705 |

| 25-February-2011 | 0.049122 |

| CLICK HERE TO VIEW THE IDCW HISTORY |